Understanding Employee Shareholding

Employee Sharholding is an investment with many advantages, developed within the company. The sums placed in the Company Savings Plan (PEE/PEG) are invested in the financial markets through FCPEs made up of shares of your company.

With Employee Shareholding, you link the returns of a portion of your savings to the stock market performance of your company and you participate in its growth. As a shareholder, you will have a better vision of its strategy and its financial stakes.

Employee Shareholding is open to all employees. A period up to 3 months within the company can be required and participation is optionnal.

Profitability

The shares are usually bought under preferential conditions : discount on prices, tax benefits. It depends on your country of residence.

Availability

The sums placed on a Company Savings Plan (PEE / PEI) are blocked for 5 years.

Some situations allow you to request an early release of your funds while maintaining tax benefits.

Security

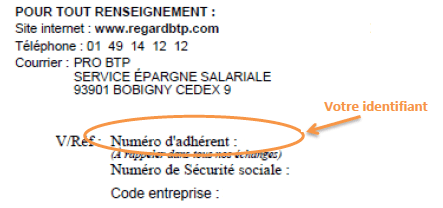

REGARDBTP, the Custodian/Account Keeper (TCCP), guarantees the distribution and redemption of the FCPEs units.

Employee Savings Plans enable you to accumulate savings with your employer’s help and benefit from tax incentives and reduced social contributions, depending on the country local tax regulation.

The Company Savings Plans (PEE/PEG) are five years plans allowing you to finance mid-term projects.

Contributions

The contributions on your Company Savings Plan are carried out through your employer. It is your employer who asks you if you want to participate to Employee Shareholding operations. He centralizes all the requests, validates them and transmits them to REGARDBTP.

Employees are free to save or not. Their payments on Company Savings Plans (PEE/PEG) are limited to one quarter of their gross annual salary.

Retirees who have kept savings in their plan can continue to feed it and take part of Employee Shareholding operations, providing that the Company Savings Plan allows it.

Advantages

Depending on your country of residence, the tax benefits may be different.

Contact your local correspondent to find out about the tax benefits for your situation.

Availability

The funds are blocked during a 5 years period. However, some situations may allow anearly redemption of all or part of your capital while maintaining the tax benefits.

Contact your local correspondent to find out about them.

At the end of the plan, any capital gains may be exempted, in full or partially, from income tax but may be subject to other taxes depending on your country of residence.

Contact your local correspondent to find out the tax regulations applying to your situation.